I want to start off by saying I’m not a lawyer and there’s some lawyery stuff in here you need to think about so this isn’t legal advice. In addition I am not a pro at venture capital by any means. I’m just a simple man trying to make my way in the universe.

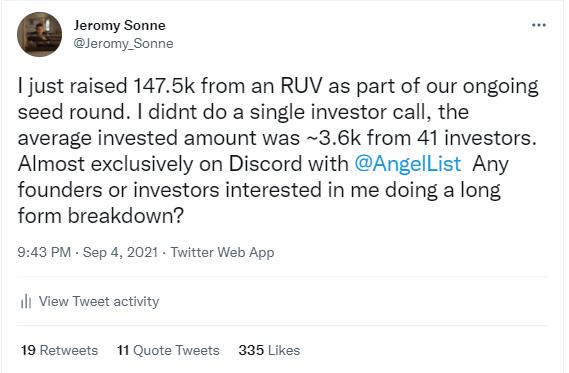

So I sent out this tweet (like too many stories start) and had over a hundred people reach out to see how we were able to pull this off.

How did this start?

There is a series of events that lead to this that I want to quick call out. Despite being in startup circles for a while I had never heard of an RUV until late July. A good friend of mine Kareem Sabri (who later invested) posted our deck into an angel investor channel in OnDeck (This really great community for super talented entrepreneurs and more). From there we got 2 angels to invest (within 7 minutes of having the pitch call) who were Geoff YuHasker and Samir Shah. These 2 angels have been crazy value adds and anyone would be lucky to work with them. Geoff about a month later mentioned that he was a part of something called RUV alliance which was a group of folks that invested utilizing a tool from AngelList called RUVs or roll up vehicles. This basically was a clean way to take lots of tiny checks, aggregate them, and assign voting rights to the CEO (me) so you can have the benefits of a normal SAFE document while being able to handle lots of smaller investors. Traditional wisdom is you want a “clean” cap table and this gave best of both worlds. We thought it would be a fun way to do a quick 25k to help move things along to our ultimate goal of 500k.

RUVs? SAFEs? What?

Sorry I’m terrible when it comes to acronyms. I am going to miss a lot of nuance here but I want to quick define some key terms.

RUV – (I’m just going to steal AngelList’s definition to start) Roll Up Vehicles are a type of Special Purpose Vehicle designed for founders that want to efficiently raise capital from individual operators and angels with a single cap table entry. Traditional SPVs often require a stand-in investor to take on additional duties by acting as the GP or Fund Lead to avoid conflict of interest issues for the founder. Roll Up Vehicles are designed to not need a stand in investor and can be created by the founder.

TL;DR: RUVs are a way to have a single link for lots of small investors to jump in and AngelList does the KYC and all the admin “stuff” so you can make it worth while to take as low as $1000 per angel.

SAFE – (Starting by stealing Y Combinator’s definition for the SAFE) Y Combinator introduced the safe (simple agreement for future equity) in late 2013, and since then, it has been used by almost all YC startups and countless non-YC startups as the main instrument for early-stage fundraising.

Tl;DR Basically it’s a convertible note or debt that later converts to equity. Investors give you money. You can use that money right away rather than closing a round all at once. There’s some different ways to customize SAFEs for your own purposes. It kicks the can down the road on the “messy” valuation stuff and lets you get to work at a Seed / Pre-Seed stage while in the future you can do a priced round. If you simply Google ‘YC SAFE” there’s a lot more intelligent people than I that have written at length about these and the various advantages they have. We are using them for our seed round because speed matters a lot to us.

How do you setup a RUV with AngelList?

This is actually incredibly simple. You go here and simply sign up. They ask you some questions about how much you’re raising, your SAFE terms, and some other stuff. It’s absurdly easy. AngelList has taken a fairly complex thing and made it pretty absurdly easy, and for most folks its FREE. As in no fees. Game changer.

What is RUV Alliance?

RUV Alliance is a discord group that a person named Harvey Multani, a man I’m reasonably convinced doesn’t actually ever sleep, put together to help founders get funding from a larger group of small angel investors. You aren’t actually allowed to publicly advertise that you’re doing an RUV while you’re doing it so he put together a private group of folks in a chat app so you can chat and have more of a flowing group conversation rather than go one on one over and over the same questions with each investor. Part of the “magic” with an RUV is having a network of people that actually invest to do it. Harvey bridges that gap and does it really well. He also has an application process so that quality stays up for investors. It’s really win win. If you want to check them out you can do that here.

What I thought would happen. What did happen.

We applied and with the help of Geoff and Samir got in and got live. We set an initial goal of $25,000 which we met pretty quickly. We extended the cap to $50,000 which we also go to, then $75,000. We languished around that point for a while until the last few days when the looming deadline helped push a lot of fence sitters over and over the last week we managed to land at nearly $150,000. To be clear I see most of the companies raising 25k to 50k. They aren’t doing badly but there’s also a reason that a bunch of them reached out to us to see how we were doing so well. 25k is probably a reasonable outcome from RUV Alliance right now. 150k is on the right side of the bell curve. That didn’t happen by accident.

What I (think) we did right.

Again I am no fundraising expert. I am here simply sharing my experiences. Take from this what you will. That said I am a marketer, and I have been doing growth marketing for a decade. I’ve take a song to #1 global viral on Spotify, a book to #2 overall on Amazon on Black Friday, etc. etc. I understand the importance of building and harnessing momentum to make things happen. Rather than opine about how great I am though I’ll give a bulleted list instead of things we did that helped. Later, I’ll say things I did that I don’t think I did a good job at. Hopefully this will help you be successful. A lot of this advice is quite general too and frankly useful for any startup raising money in any way.

-I engaged all the time. Any product update we had? That was an update in channel. New user sign up that is notable? Better believe I was telling everyone. Partnership? New inventory partner? Revenue goal beaten? Brought on a new team member? All of it. Transparency is highly underrated even though everyone talks about it all the time. Don’t just answer when asked but volunteer info constantly.

-We had a really investor friendly valuation. For our SAFE we did a “cap no discount” which means there’s a valuation cap so if we have a big jump in valuation at our A round investors will get an outsized return. A lot of seed stage startups are raising at a 15 million + valuation. We did a 5.5 million post money cap. That made us attractive. The trade off is you lose more equity at a lower valuation but we aren’t raising a lot anyways so it didn’t matter to us as much. Our mantra has been to raise as little as possible and that’s held up.

-I set incremental goals and made a big deal about increasing the cap. Announcing that we were going to once again raise the cap gave the perception that this thing was growing like wild fire (and it was).

-Don’t discount one on one engagement. I have plenty of DMs with investors that wanted to speak privately. I made sure to answer all their questions even the ones that are harder. Worst case I would say “I don’t know but I bet we’re the team to figure it out” and 9 times out of 10 that worked. In addition I’ve been slowly doing intro calls with people after they invested. In some cases they’ve increased their investment. In others they simply became an in channel advocate.

-Build in community advocates. I reached out to a number of people that invested and basically built an engagement pod like you would on Instagram for more organic reach. I wasn’t shy about asking for signal boost on big updates and that helped a lot.

-Use Journey It’s an extremely helpful tool that lets you build a visual story with your raise and have all your links and resources in one place. It’s basically a super deck and we’re going to use it for sales after the raise is all over as well.

-Make friends with Harvey. I reached out and Harvey and I chatted a lot. He’s a solid person and is very passionate about alternative investing. Connecting with Harvey helped us get an edge with him doing things like sending emails and hitting up more general channels (not just our deal channel) to get people excited.

-If things got slow I brought in outside help. I reached out to other folks in our community outside the RUV alliance group if things were slow for a few days to get them to cut a check then update the channel. Breaking through lulls is huge.

-The last 72 hours was full on war room. I was engaging constantly, getting my pod to ask questions that were interesting in channel, etc. That helped spur interesting conversations that lead new folks to invest.

-Do anything you can to increase FOMO. Remind people your RUV is closing soon. That direct checks are XYZ minimum instead, that the round is filling up, that your next round will be at a higher valuation, etc. I never advocate or spell out specific outcomes and if I even do projections I always preface that with a healthy bit of warning such as (this could well fall apart at any time but…). That said you want people to effectively feel like if they don’t pull the trigger they’re going to miss out on the next big thing.

-Founder market fit. I’ve been in marketing for a decade. Greg has 20 years of technology experience. The rest of our team brings incredible talents to the table. When we can intelligently talk about the problems that the industry has and the specific way we’ll leverage our tech to solve them that’s a compelling story to convince people we’re the right folks for the job. We didn’t start with this but by the end we led with it.

-Lastly, and this is true for any startup seeking any investment not just RUVs, traction is king. We had a few massive opportunities kick off pilot programs with Decibel during this process. When you can point to something that even has the potential to get you to a 7 figure MRR if the pilot goes well you have a very interesting story to tell investors as to why now is the time and you’re the team to do it.

What I did wrong

-I didn’t have the RUV piece with AngelList figured out before signing up so I wasted too many days dragging my feet on that piece.

-If I could do it all over I would start with an RUV and let it run longer. I would pitch angels on our direct 25k minimum and then if they said no simply send them the RUV link as a follow up.

-I would have done most of the above that I mentioned significantly sooner. A lot of this I figured out as I went. Having a general plan or framework would have helped a lot more than winging it.

That’s all he wrote.

Hopefully this was helpful. When I sent out the Tweet I was mostly excited and not expecting this sort of response. RUVs are a great tool and AngelList / RUV Alliance are amazing platforms changing the game for founders. Hopefully my rantings came off as useful and you all can use these lessons to go forward and fund your companies. If you want to drop me a notej@decibelads.com is the best way to reach me. Thanks for reading!